Are Hedge Funds Really Worth the Fees They Charge?

From the Desk of Our Managing Partner, Randy Hubschmidt

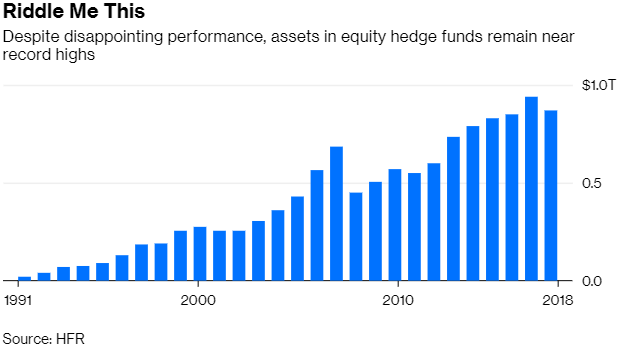

As Bloomberg’s Nir Kaisser so adroitly pointed out in his recent Opinion piece, money continues to flow in to hedge funds even as hedge funds continue to underperform.

Back when there were fewer hedge fund managers, there was less competition for good deals and hence, more opportunity for tremendous returns. Just as more entrants chase the same (or similar) strategies, reversion to the mean inevitably occurred. High fees, low tax efficiency and illiquidity all add up to significant underperformance.

Sound familiar?

As many of you know, my colleagues and I at Fortis Wealth have been ardent advocates for building TOTAL wealth, not chasing fads.

As shown in the chart below hedge fund assets have exceeded pre-2008 levels. The 10 year bull market has emboldened investors to once again roll the dice…

Notice the spread between the HFRI Equity Hedge Total Index and the Bond Index shown in the chart below.

Conclusion

If you’d like to learn more about our unique philosophy for managing wealth, visit our website www.fortis-wealth.com