Concerned About Filing an Extension?

July 2020 / by Fortis Family Office Tax Team

R-E-L-A-X

LETTER FROM OUR MANAGING PARTNER

In September of 2014, future Hall of Fame NFL quarterback Aaron Rodgers had a simple message for Green Bay Packers fans who were panicking over the team’s 1-2 start to the season. “Five letters here just for everybody out there in Packer land: R-E-L-A-X,” he said on his weekly radio show, spelling the word out for effect. I share this on the heels of last week’s announcement from the Treasury Department that the federal tax deadline, which had been extended to July 15th because of the coronavirus pandemic, would not be extended further. “After consulting with various external stakeholders, we have decided to have taxpayers request an extension if more time is needed,“ Treasury Secretary Steven Mnuchin said in a statement.

An EXTENSION….a word that can make taxpayers as uneasy as a football fan whose team is failing to live up to expectations (rather than spell it out as Rodgers did, I went with the equally annoying all-caps approach). Even in normal tax years with an April 15th deadline, I have encountered taxpayers anxious about the thought of filing an extension. As someone who has prepared and reviewed tax returns for multi-family office clients for over 20 years and has worked closely with the IRS, I can assure you that filing an extension for your tax return is not only incredibly easy, but encouraged by the IRS if it will allow you the extra time needed to file a complete and accurate tax return. I recently confirmed this position in a conversation with an audit manager within the Global High Net Worth division of the IRS. He could not have been more adamant that not only does an extended tax return not result in increased audit risk, but on the contrary, it is more likely to avoid the need to amend a hastily filed return, which can trigger an audit.

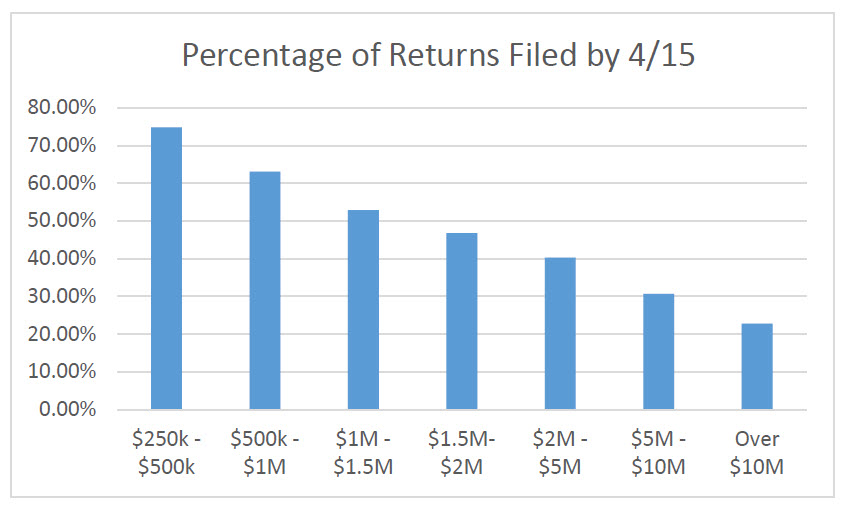

It is understandable that you would prefer to file your return as soon as possible and officially turn the page from the prior tax year and, if your information is available, go right ahead. As taxpayers’ investment portfolios have become more complex, however (and income increases), so too does the likelihood that an extension will be necessary. 90.7% of taxpayers who earned between $50,000 and $75,000 in 2018 filed their tax returns by the original April 15th deadline, without requiring an extension. Those percentages begin to decrease, however, as taxpayer income increases.

The reality is that the more complex your investment portfolio becomes, the greater likelihood that one or more of those investments was made through a partnership or LLC which files its own tax return and then issues a Form K-1 to you as the partner/member. Unlike your W-2 or 1099 from an investment account, these forms are not due to the IRS until September 15th (if extended from the original March 15th deadline). Many of these entities are waiting on K-1’s themselves and so there can be a trickle-down effect which makes it impossible for the returns to be filed by the original due date. The good news is that in 2017 the IRS decided stop torturing tax preparers and moved the extended due date for partnerships and LLC’s from October 15th to September 15th, which leaves a full month when an individual should have 100% of their tax information in order to complete their return (you can imagine the stress for tax preparers prior to 2017 who were waking up on October 15th still waiting on a K-1 that was needed to file a client’s return that was due THAT SAME DAY).

So how does this work? It is important to note that the extension is to file your tax return, not to pay any tax that is due, and so you will need to pay – normally by April 15th, but this year by July 15th – what you expect to owe when you actually file your taxes later in the year. Other than that, it is as simple as filing a one-page form (Form 4868) for an automatic six month (three months this year) extension to file your taxes. As implied, the request is automatic, and the IRS does not even have to approve it. You then have until October 15th to gather your information and file your tax return.

The 2014 Packers followed Rodgers’ calming words to rebound from their rough start to finish the season 12-4 and advanced to the NFC Championship. If you don’t expect to have received all of your tax information by July 15th, or you just don’t have the time to gather it, don’t panic, R-E-L-A-X, and file Form 4868 to extend the due date until October 15th. The IRS does not make many accommodations for taxpayers – you should not feel guilty about utilizing this one.