Investment Opportunities in Student Housing

Demographic and macro-economic trends favor this alternative to traditional investment.

By Randy Hubschmidt

Fortis Wealth, Managing Partner

Key Takeaways

-

Investment in student housing is approaching record levels.

-

Student housing generally weathers recessions—and rising interest rates–better than most other asset classes.

-

Gaining access to this asset class remains a challenge for individual investors. Think twice about being a do-it-yourselfer.

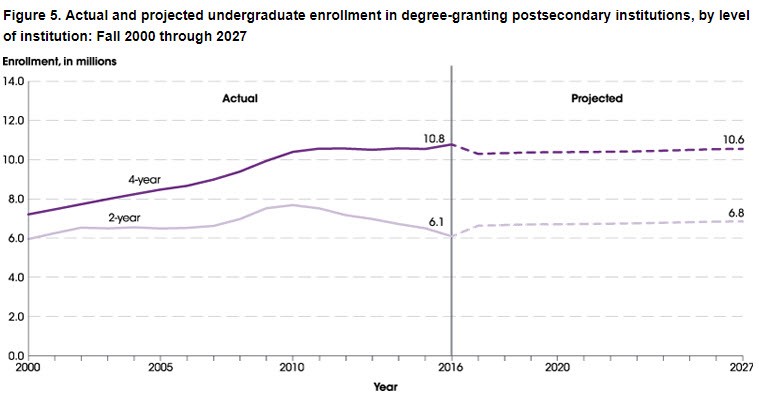

With college enrollments continuing to rise and the stock market expensive by historical standards, student housing has become an increasingly attractive alternative to some traditional investments. Student housing transaction volume totaled a record $9 billion in 2016, a 62-percent increase from 2015, according to a report by Axiometrics. After a brief pause in 2017—more a statistical anomaly than a market trend–three-quarters of investors surveyed by CBRE expect to increase their exposure to student housing in 2018.

The biggest challenge for investors of student housing is gaining access to this asset class. On the private side, we’re seeing a tremendous amount of investment in that asset class. It’s more difficult for clients and other investors to get access via the public markets.

Unique advantages of student housing investments

Unlike many other investments, including traditional real estate, student housing is generally recession-proof. That’s because young adults tend to go back to school when the economy is soft and job prospects are meager.

SSSource: National Center for Education Statistics

Another advantage is that students tend to sign one-year leases. It’s analogous to buying a one-year CD. The rates will reset annually, which can work to your advantage in a rising rate environment–or in this case–a rising rental market environment. Additionally, if the property is desirable, well maintained, has good amenities and is located close to campus, renewals of those one year leases tend to occur well in advance of their anniversary date. That’s because kids who know they will be attending that school the next year will once again want to renew their apartment lease long before the September start of the school year. Both occupancy rates and renewal rates tend to be VERY high when it comes to student housing.

What are the best ways to invest in student housing?

Sure, you could purchase an apartment building and turn it into student units. But, one of the difficulties with “turning” an existing apartment building in the student housing market is that you run the risk of alienating your current tenant base as you start to transition that asset from multi-family tenants to student tenants. These groups tend to have different schedules and different tolerances for noise. You could also have issues with local laws whereby privately-owned student housing may not meet the local municipal ordinances.

Risks associated with student housing investments

One of the biggest risks, as with any real estate investment, is competition in the marketplace. One needs to be aware of competing projects both existing and in the works. Similarly, the schools themselves could elect to build their own on-campus student housing. Real estate continues to be local in nature and myriad issues could affect the marketability and desirability of a project.

Long-term outlook for student housing as an investment sector

A college education continues to be in high demand, and there doesn’t appear to be any reason for this to subside. And so long as a college education is valued, the need for student housing will be there. Certainly, cost will be a factor. But, as college enrollment continues to increase, this asset class should continue to perform well. As previously stated not only does it tend to be somewhat recession proof, history has shown that enrollment actually increases as the economy stalls and jobs become more difficult to find. And as long as that demand continues there should continue to be demand for housing.

According to Axiometrics data, U.S. college enrollment growth has increased by 6.4 million students over the last 20 years and the 14 to 17 year-old demographic continues to grow compared to previous generations. All these factors continue to attract investors to an investment space that is still considered young by commercial real estate standards.

Conclusion

If you or someone close to you is concerned about your lack of diversification or wealth building strategies, please don’t hesitate to contact us.